Introduction

Welcome to a fresh look at a financial metric that’s both simple and powerful: Return on Equity (ROE). If you’re looking to understand how well a business turns investments into profits, ROE should be at the top of your list. Today, we'll go beyond just defining ROE; we’ll explore what it reveals about a business, its drivers, and how it fits into a broader analysis. Whether you’re an investor, a business owner, or an accountant looking to sharpen your analysis skills, ROE has a lot to offer.

1. The Basics of ROE: Measuring Profitability

At its core, Return on Equity (ROE) is a measure of how effectively a company uses shareholders’ equity to generate profit. Essentially, it shows the financial returns a business creates for its owners. Here’s how it’s calculated:

ROE=Net Income / Shareholders’ Equity

Net Income: This is the profit after taxes (found on the income statement).

Shareholders' Equity: The value shareholders own after assets cover liabilities (found on the balance sheet).

In other words: ROE tells us how much profit a company makes for each dollar of shareholder investment. A higher ROE indicates more efficient use of equity – a positive sign for current and potential investors.

2. Why ROE Matters: Efficiency and Profitability in One Metric

ROE serves as a performance check for business owners, investors, and analysts alike. A high ROE suggests strong profitability, effective management, or both. Here’s how ROE helps each group:

For Investors: ROE is a sign of growth potential. Investors see high ROE as a positive indicator that their funds are generating good returns.

For Business Owners: ROE acts as a profitability benchmark, indicating if the business’s investments are paying off.

For Analysts: ROE, combined with other ratios, reveals the effectiveness of a company's strategy and financial management.

3. Breaking Down ROE

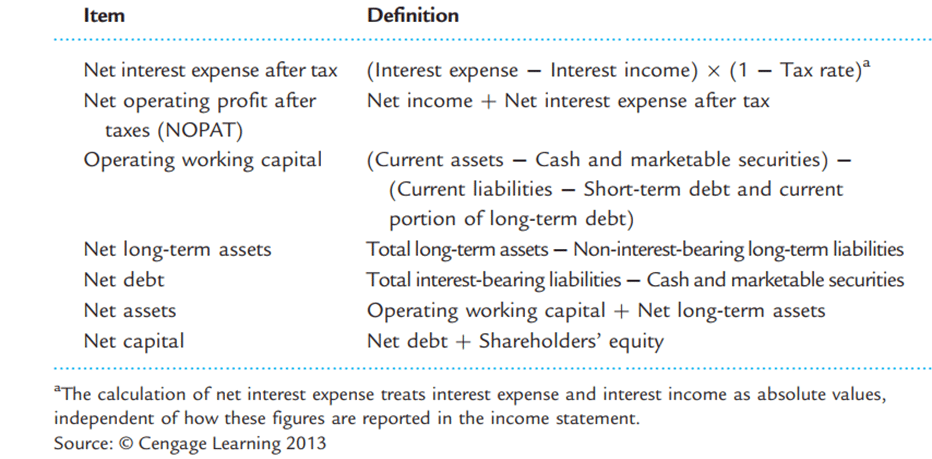

While the basic ROE formula is straightforward, breaking down into operating and non-operating components reveals much about a company’s financial performance:

ROE=Operating ROA+ (Spread × Net Financial Leverage)

Operating ROA = Net operating profit after tax/ Net assets

Spread = Operating ROA – Effective interest rate after tax

Net Financial Leverage = Net debt/ Equity

This breakdown combines three elements: Operating Return on Assets (ROA), Spread, and Net Financial Leverage.

Operating ROA (Return on Assets)

What it is: Operating ROA measures how profitably a company can use operating assets to generate operating profits.

Decompose: Operating ROA = NOPAT/Sales x Sales/ Net assets

✋✋ NOPAT margin (NOPAT/Sales) is a measure of how profitable a company’s sales are from an operating perspective.

✋✋ Operating asset turnover (Sales/ Net assets) measures the extent to which a company can use operating assets to generate sales.

Application:

✋✋ Breaking down the NOPAT margin helps assess how well a company is managing its operations by looking at key parts like revenue, cost of sales, and operating expenses to see what’s driving those numbers.

✋✋ Breaking down the operating asset turnover helps evaluate how efficiently a company manages its short-term resources (like cash and inventory) and long-term assets. Ratios such as accounts receivable turnover, accounts payable turnover, inventory turnover, and long-term asset turnover can be useful for this analysis.

Spread

What it is: Spread represents the difference between Operating ROA and the cost of debt. This component shows the profitability of leverage.

Application

✋✋ In the long run, the value of the company’s equity is determined by the relationship between ROE and cost of equity capital. The positive spread indicates the higher market value compared to book value.

✋✋Spread could also be used to assess future profitability. Long term consistent positive spread will attract competition which will eventually push ROE to normal level – the cost of equity capital.

Net Financial Leverage

What it is: This ratio shows the degree of a company’s debt compared to equity, illustrating how much borrowed money influences profitability.

Consideration: While financial leverage can benefit shareholders, it can also increase risk due to the predefined payment terms and financial distress if it fails to meet commitments. Ratios such as current ratio, quick ratio, operating cash flow ratio, debt to equity ratios need to be used to evaluate the degree of risks from financial leverage.

Together, these components reveal how ROE is affected by a company’s efficiency (Operating ROA), the profitability of its debt (Spread), and its reliance on debt (Leverage).

4. Interrelationships Within ROE

Understanding the interplays between Operating ROA, Spread, and Leverage can provide deeper insights into what’s driving ROE:

Operating ROA Impact: A high Operating ROA means a company is effectively using its assets, which directly boosts ROE.

Spread Significance: If the company’s Operating ROA is higher than its cost of debt, debt financing enhances ROE by adding profitable leverage.

Leverage Effect: Net Financial Leverage amplifies both Operating ROA and Spread, potentially increasing ROE but also introducing higher financial risk.

5. Considerations and Risk Factors in ROE Analysis

While ROE is insightful, there are factors that can distort it, along with risks that come with leveraging it

High Debt: Debt can boost ROE but also brings higher risk. When a company relies heavily on debt, economic downturns can impact ROE and financial stability.

Low or Negative Equity: A company with low or negative equity may have an exaggerated or erratic ROE.

Non-Operational Factors: ROE may be skewed by accounting practices, one-time gains, or other non-operational items. It’s important to consider the quality of earnings.

Market Conditions: ROE can fluctuate with market dynamics, and isolated analysis might be misleading. Examining ROE alongside other metrics, like Return on Assets (ROA) and Debt-to-Equity ratio, offers a fuller financial picture.

6. Industry Matters: Using ROE for Comparisons

ROE is most useful when compared within the same industry since different industries have varying capital requirements. For instance, tech companies usually have higher ROEs due to low capital needs, while utility companies often have lower ROEs due to their high infrastructure costs.

Key Takeaway: Use ROE as a Compass, Not a Map

While ROE provides valuable insights, it’s even more powerful when combined with other financial metrics, such as Return on Assets (ROA) or the Debt-to-Equity ratio. This holistic approach helps you not only assess a company’s profitability but also its financial stability and efficiency.

Consistent ROE over time is generally a good sign, showing that a company has the potential for stable growth. But sudden fluctuations? Those may indicate shifts in debt, profit inconsistencies, or other underlying factors worth investigating.

Closing Thoughts

In a world of complex financial analysis, ROE shines as a straightforward measure of how well a company generates profits from its investments. By using ROE as part of a broader analysis, you’ll gain a well-rounded view of a company’s performance and be better equipped to make informed decisions.